Like many industries, U.S. Manufacturing was not spared from the disruption of the COVID-19 Pandemic. Manufacturers faced significant challenges during the pandemic, from forced factory shut downs to shifting to solely producing essential supplies. Product shortages and capacity constraints implicated supply chains. The safety and wellbeing of the essential workforce created changes to Personal Protective Equipment (PPE) requirements, as well as health and environmental policies. Many companies moved non-production workforce to remote sites, mainly worker’s homes. Nobody was prepared for this pandemic and the impact is not over.

So, where does manufacturing stand now?

Manufacturing companies have been and will continue to re-open and ramp up production, but it is clear that the manufacturing landscape is changing. Let’s take a look at some current trends that are causing the landscape to shift, such as:

- Supply and Demand

- Localized Supply Chain-Reshoring

- Investment in Technology

- Lack of Skilled Workforce

Supply and Demand:

A June 1, 2021 report from Reuters says that although U.S. Manufacturing is gaining steam, demand is even higher. The economy is opening back up and consumers have stimulus checks and money saved from the lock down they want to spend. E-commerce sales are even hitting new high. However, the economy is struggling to keep up with demand.

Manufacturers, in particular, are facing long lead times, or even unknown lead times, because of shortages of raw materials, price increases on commodities, as well as freight, and even difficulties in transporting products.

What is causing the price increases and shortage of raw materials?

For one, there continues to be a reduction in productivity. Some factories had to close or reduce their workforce due to COVID-19 lock downs, which led to falls in raw material supplies. Labor shortages continue to keep these factories running at a lower capacity.

Secondly, the overall freight environment has seen a strong demand. This demand has pushed shipping to maximum capacity, causing freight rates to soar. Also, the shortage of freight containers has also led to further price hikes, which is predicted to continue until 2022. Many containers are stuck in ports without a workforce to process them, which makes it difficult to book container space. Therefore, carriers are changing their rates, adding new surcharges and leasing prices.

It’s been an endless cycle, and as Breakthrough Supply Chain’s Brooks A. Bentz writes in Logistic Management, “There is no end in sight.” “This signals a permanent behavioral shift of an indeterminate magnitude. In fact, it has provided an opportunity for carriers, vehicle manufacturers, and tech companies to research, test, and invest in alternative ways to provide pick up, transport, sortation, and delivery.”

Logistic Management also reports, “Trucking, air cargo, ocean cargo, and even rail—which shippers are increasingly turning to as an alternative to their traditional transportation choices—are all feeling similar impacts, many of which may carry through the summer and into the fall. With manufacturers, distributors, and retailers already preparing their Black Friday and Cyber Monday shopping campaigns, capacity constraints, driver shortages and other freight-related issues may continue right into the peak holiday season.”

Transportation companies are experiencing difficulties recruiting new drivers in order to keep up with high demands. During the pandemic, state agencies were limited, or shut down, due to COVID restrictions and could not provide the in- person and on the road training to certify new drivers, leading to an industry-wide shortage.

Reshoring:

Due to the current state of the supply chain, another major trend is companies reconsidering how they can meet their sourcing requirements, and how they can do it locally, in the United States. Thomasnet, or Thomas, a manufacturing watcher and leader in product sourcing, supplier selection and marketing solutions, released data from a recent survey they conducted with manufacturers, mainly OEMs, that supports this trend.

In their report, “State of North America Manufacturing” published in June 2021, 83% of manufacturers surveyed stated they are planning to add North American suppliers to their supply chains within a year. This is an increase by 54% from 2020. Thomas estimated if 83% of the 579,811 manufacturers in the USA were to bring on one new supplier, it amounts to a potential $443 billion injection into the U.S. economy. Although many manufacturers find reshoring important, others still see barriers to it. 40% of buyers who were also surveyed, reported price as the most significant barrier to reshoring, followed by speed, or lead time at 23%. Other barriers reported were limited suppliers in the U.S.A., such as smaller electrical parts. Manufactures may have no choice but to go offshore, unless U.S.A. suppliers are strengthened. Despite these barriers, the majority of survey respondents are still planning to re-shore their operations.

Per Thomas, U.S. and Canada-based operations leading the charge for reshoring are the automotive and oil and gas sectors.

“We are witnessing the wholesale reexamination of supply chain relationships, which will realign global manufacturing for decades to come. With North American businesses accelerating reshoring and replacing some of their overseas suppliers with domestic alternatives, U.S. manufacturers are being presented with an unprecedented opportunity,” said Tony Uphoff, Thomas president & CEO.

Investment in Technology:

While COVID-19 exposed weaknesses in supply chains, it also emphasized the importance of adopting more industry technology in manufacturing. Pre-pandemic, technologies were starting to be implemented and transforming operations, but the pandemic has accelerated the need.

Many internet articles focused on industry technology trends post pandemic are available to review, but one by the Association of Equipment Manufacturers, or AEM, provides a great break down of 6 key technologies that manufactures are starting to embrace post pandemic.

- Industry 4.0: Industry 4.0 enables transformational leaps in productivity, cost reductions and operational visibility. IoT, a key component of Industry 4.0, has been trending for the past few years, but it is also finding its stride in supporting mitigation of the impact of COVID and its social distancing and capacity constraints.

- 3D Printing: As product lifecycles continue to become compressed, 3D printing supports getting new products to market faster. Rapid prototyping minimizes the time, effort and investment to develop working prototypes.

- Automation and Sensors: COVID capacity constraints and social distancing requirements are driving the need for even more automation. Automation helps enable production with minimal or zero human intervention. Sensors on factory floors or machines can also notify workers they are standing too close to each other.

- Paperless Factory: Being paperless has been a goal for many companies, more so for environmental purposes, but COVID is shaping up to be the final push to get manufacturers to finally do away with paper as virus-transmission risk-reduction becomes a new and important reason to digitize paper forms. As well, paper forms are no longer viable, because face-to-face interaction is now significantly limited.

- Digital Twins: A digital twin is a virtual replica of a facility/plant floor. Digital twins are now being used to manage the performance, effectiveness and quality of a manufacturer’s fixed assets such as manufacturing machines, lines and plants. Some companies are using digital twins to allow their customers to participate in virtual tours.

- AI and Predictive Analysis: While AI and predictive analytics were trending prior to COVID, they now play a vital role in informing processes to make manufacturing more precise, eliminate waste and forge competitive advantage.

Lack of Skilled Workforce:

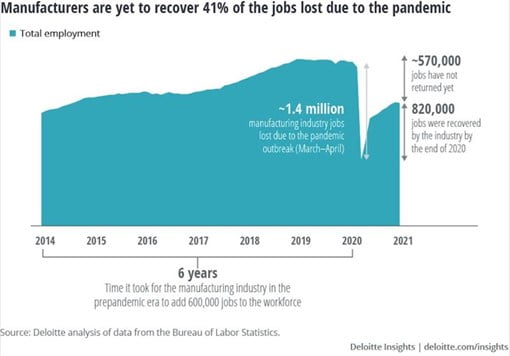

According to a report by Deloitte and The Manufacturing Institute entitled, “Creating pathways for tomorrow’s workforce today: Beyond Reskilling in Manufacturing” 1.4 million US manufacturing jobs were erased due to the pandemic. 820,000 of those jobs were hired back by the end of 2020. However, the remaining 500,000 plus continue to be unfilled.

The National Association of Manufacturers (NAM) found that attracting and retaining quality workforce is one of the top challenges for manufacturers. The skills gap in manufacturing has been a headline for many years and remains the headline today post pandemic. Manufacturers are not able to fill entry level positions, let alone skilled workers for specialized roles.

Here are some other staggering findings from a recent survey conducted by Deloitte and The Manufacturing Institute:

- Finding the right talent is now 36% harder than it was in 2018, even though the unemployment rate has nearly doubled since.

- The top two consequences cited by manufacturers of not being able to fill jobs were the inability to increase revenue growth (82%) and maintain production levels to satisfy demand (81%).

- Seventy-seven percent of manufacturers surveyed, say they will have ongoing difficulties in attracting and retaining workers in 2021 and beyond.

- The survey states the top reasons these positions tend to go unfilled: New entrants having different expectations for jobs and careers topping the list (38%), followed by lack of attraction or interest in the industry (36%) and retirement of baby boomers (34%).

- 8 in 10 job titles with the highest number of job postings in 2019 and 2020 were for entry and mid-level positions, generally requiring only a post-secondary certificate or high-school diploma.

The manufacturing skills gap is anticipated to leave 2.1 million jobs unfilled by 2030 and could cost the U.S. economy as much as $1 trillion dollars.

Paul Wellener, vice chairman and U.S. industrial products and construction leader, of Deloitte LLP expressed his concerns, “Given the foundational role the manufacturing sector plays in our nation’s economy, it is deeply concerning that at a time when jobs are in such high demand nationwide, and the number of vacant entry-level manufacturing positions continues to grow. Attracting and retaining diverse talent presents both a challenge and solution to bridging the talent gap. To attract a new generation of workers, the industry should work together to change the perception of work in manufacturing and expand and diversify its talent pipeline.”

DuraTech Industries – Current State:

In the spring of 2020, during the pandemic, we were designated an essential business, which allowed us to remain open to support many of our customers who have been vital in the fight against COVID-19. These companies relied on us to provide specific printed components, such as overlays, labels/decals and membrane switches, of which conveyed user instructions, displayed product identification and safety information, or indicated important health information about patients.

Post pandemic, we have welcomed back the majority of our customers. Less than 10% are still working from home. We are experiencing a steady flow of business. Buying is no longer just for essential products. In fact, buying is not slowing down.

Unfortunately, we are experiencing force majeure with suppliers of different commodities we use, from plastics to aluminum, to boxes and adhesives. Amy Wheeler, DuraTech’s Purchasing & Material Handling Team Lead, shares that delays are not only of raw materials, but also those of freight carriers. Delays in freight hubs are causing freight to sit waiting for trailers and drivers to be available to haul freight to destinations.

DuraTech has also experienced multiple price adjustments from many key suppliers. According to Wheeler, “Materials have increased in price from 1.5% up to 25% over the last 8 months. Suppliers have been able to work with DuraTech to slowly implement the price increases over 3 to 4 month period, so we were not experiencing such a spike at one time.

Our purchasing team continues to closely watch inventory levels of all products and job orders are planned according to current demand and future potential.” Wheeler added that some suppliers are not allowing customers to order more product than they have ordered in the past so no to “hoard” material. Just walking through our warehouse, Wheeler says, you can see that our shelves have less product on them than in the past.

As we experience these set backs on delivery dates from suppliers, as well as price increases, we have become creative in the ways we continue to delight our customers.

Jennifer Schauf, DuraTech’s Customer Service Team Lead, says the customer support team has been very transparent in their communication to customers. In a normal situation, we may receive pushback from some customers, but Schauf says most seem to be accepting that this is happening everywhere and not just with DuraTech. If a customer has asked for us to expedite a job order, we have honored that request when we can, but not without disclosing the hike in the expedited price.

Through our technology, our customer support team will get notified if a job is done sooner than what we was predicted and that communication is immediately passed on to our customers. We’ve recently added a link to the Email signatures of our customer support team to encourage communication from customers, allowing them tell us how we are doing and what we can further help them with.

We’ve also been offering customers the choice to use alternative printing processes for certain jobs and different suppliers for materials where possible.

Our production team members having been working overtime, including working multiple weekends in a row in an attempt to bring lead times back down. Like many other manufacturers, we are continuously working on ways to identify and close skills gaps and fill job openings.

Buying is not stopping, and although we cannot predict how long the supply chain will remain in its current state, we will continue to delight our customers.

DuraTech Industries is a full-service manufacturer of custom graphics, including printed decorative and functional overlays, appliques and pressure sensitive products. We also offer In-Mold Decorating, In-Mold Electronics, doming and membrane switches. Discover more about us at www.duratech.com

DSI/Dynamatic Current State:

When the pandemic shut down the country in March 2020, DSI/Dynamatic remained open for business, though our staff was restricted to travel and some of our workforce opted to work from home. Because our eddy current drives, brakes, clutches and controls have been an important and essential part to many other businesses around the world, it was imperative to find ways around COVID-19.

Our lead engineers were tested for the virus regularly and traveled only when necessary. Unfortunately, that pushed a lot of our projects to future unknown dates. When eligible, most of our employees were fully vaccinated, which opened the possibilities for us to continue work at a more normal pace. For the last few months, our engineers have been on service calls at facilities around the country on a more regular basis, but with the Delta variant becoming an issue, we may see a regression in our efforts.

As the pandemic continues, we’re still using caution with in-person events, too. “This fall, there will be two in-person events, but only a couple people will be attending,” said Marketing Manager Rebecca Hart. “We’re trying to keep exposure as low as possible, without losing the opportunity to build our business.”

Hart said the company has stayed in touch with customers through social media, email surveys, phone calls, and appropriate updates on the company website. Reaching people has been the most important part of DSI/Dynamatic’s business in a pandemic.

“We don’t want anyone to think we’ve forgotten about them,” Hart said. “We may have been on pause with some of our projects, but our customers are always our priority. Communication, even if it was to simply say ‘we don’t know anything yet’ builds and maintains trust with everyone.”

As far as sales are concerned, DSI/Dynamatic posted stronger sales than expected for the first half of 2021. Of course, challenges remain that most manufacturers across the U.S. continue to experience. For example, the cost of goods has increased, which directly has affected DSI/Dynamatic manufacturing.

Purchasing Manager Barb Konicek said the year has been unlike any other.

“I have seen some crazy things this last year and it hasn’t come to an end,” Konicek said. “Material increases from 10 to 200% with long lead times, slow responses from vendors, as either employees are working from home, or they cannot find people to work.”

Konicek was reminded that in the end, all the challenges trickle down to our customers. “We are in a world where we need to find our patience,” she said.

Despite the busy weeks in our sales department, we’ve faced challenges related to transit time.

From a lead time standpoint, I’d say we’ve increased over the past 3-4 months mainly because of material availability,” Sales Account Manager Adam Dillon said. “The other issue we’ve faced is a huge increase in transit time, especially via LTL Carriers. I’ve had a number of late (and damaged) shipments over the past month, and things don’t appear to be getting better in that regard.”

One way, Dillon is facing this challenge head on is by simply staying in communication with the customer. When parts or equipment don’t arrive on time, we apologize and make sure they’re aware of the time frame. Dillon said he offers customers a realistic time frame with every order.

The good news is, as we grasp for silver linings in a very difficult time, all manufacturers seem to be in similar situations. As costs have increased, demand is still prevalent. As long as there is continued demand, there will be a need to keep manufacturing and to seek new business.

by Shannon Simpson-Digital Marketing Specialist, DuraTech Industries & DSI/Dynamatic, Inc.